A book that traces the origins of Money and it’s journey through the centuries – from the age of precious metals to a largely invisible form of money that we have come to trust as a store of value. The astonishing rise of financial market through the ups and downs, bubbles and bursts, manias and panics, shocks and crashes. This book shows that financial history is the back-story to all history.

***

Of all the history books that were ever published, very few have actually covered the history of finance and the rise of money. Over the centuries, greed, trust, diligence, innovation and outright fraud have shaped the financial system of today – a system that makes us believe in printed paper or some numbers on a digital screen as a store of value.

This book takes you through that journey of money. From the ages of Babylon to the medieval period and then to the modern era, the stories told in this book are the very essence of financial history.

A Spanish conquest of Inca empire in 16th century brought tons of silver to Europe that could be minted into coins. Europe struck rich and the new money financed more wars. But they dug up too much silver and eventually those coins lost their value. Money is worth only what someone else is willing to pay for it.

Fibonacci, a young son of a custom official from Pisa in Italy, introduced hindu-arabic numerals to Europe and also the famous Fibonacci sequence, first appeared as matrameru in the works of Sanskrit scholar Pingala. Most importantly, Fibonacci applied the new numeric system to making and lending money in his book Liber Abaci and thus gave a fillip to the modern finance era.

Perhaps no other family left their imprint on finance as the Medici family in Italy did. At the height of their power, the family owned the entire banking system of the region. They financed trade and the wars, engaged in currency trading and even funded the renaissance art. The family became so powerful that members from the lineage became popes, queens and dukes. Eventually they became too rich and powerful for their own good and had to reined in by the monarch.

The Dutch, English, and Swedes further refined and improved the original system established by the Medici family, which ultimately gave birth to the modern banking system we know today.

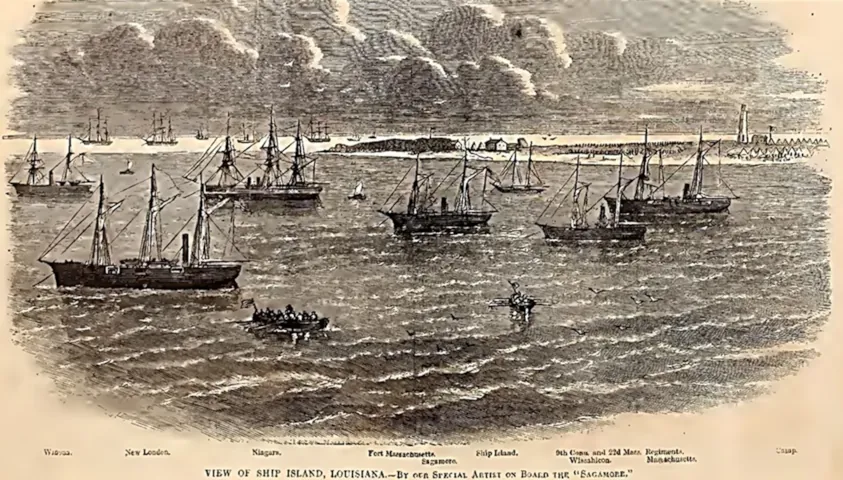

You would have read about the famous war that were fought and won but fighting is not possible without money to pay for it. War is the father of the bond markets, the second great revolution in the ascent of money. 800 years ago, city-states in northern Italy needed money to pay for condottieri to fight wars and they came up with the idea of tradable bonds.

After the Medicis, the Rothschild family ruled the financial markets in 18th century. They moved money to finance the coalition that defeated Napoleon at Waterloo in 1815 and made fortunes. Bond markets rule the world and influence every financial decision we take.

The first IPO was launched by Dutch in the early 17th century to raise money for United Eastern India Company – a joint stock company set-up for spice trade with India and other Asian territories. An informal stock market sprung up soon after to share the trades.

Two Scottish Church ministers invented the first true insurance fund. The Scottish Ministers’ Widows’ Fund was the first ever life insurance fund set-up more than 250 years ago to pay annuity to the widows and children of the deceased ministers. Today insurance and pension funds are the biggest investors dominating global financial markets.

Today’s financial world is the result of four millennia of economic evolution. It has been a roller-coaster ride of ups and downs, bubbles and bursts, manias and panics, shocks and crashes. Understanding the origins of this evolution is important to fully know the true nature of money as we see it today. In a way, the financial markets are a true mirror of the mankind and this book illustrates that well.